Your current location is:Fxscam News > Platform Inquiries

Fed division deepens, complicating rate cut expectations and adding uncertainty to markets.

Fxscam News2025-07-22 15:54:09【Platform Inquiries】3People have watched

IntroductionForeign exchange broker evaluation website,Foreign exchange payment process,Rising Internal Disagreements in the Federal Reserve: Uncertainty Surrounds Rate Cut PathThe minutes

Rising Internal Disagreements in the Federal Reserve: Uncertainty Surrounds Rate Cut Path

The Foreign exchange broker evaluation websiteminutes from the Federal Reserve's June meeting, recently released, reveal increasing internal disagreements over future interest rate policies. While some officials advocate for swift action to address potential economic slowdowns, most policymakers argue that the current economic and employment environment allows for patience and further data evaluation.

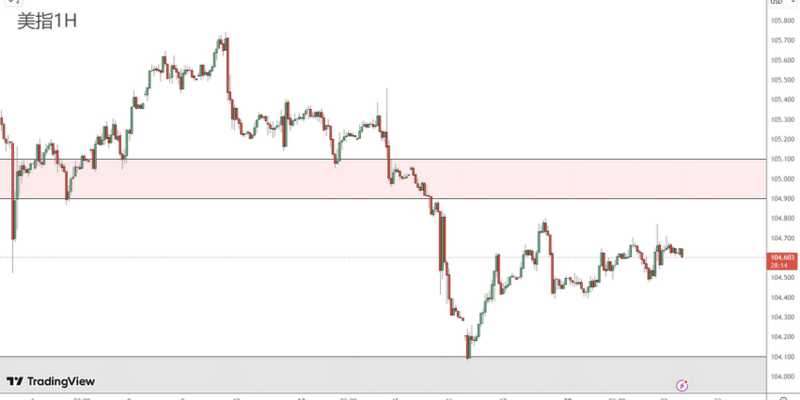

Against the backdrop of maintaining unchanged rates, the Federal Reserve remains cautious about whether there is a need to adjust rates in the coming months. Market participants believe the complexity surrounding rate cut expectations could lead to volatility in U.S. Treasury yields and the dollar's trend in the months ahead.

Three Factions Highlight Officials' Divisions

The latest minutes indicate three main factions within the Federal Reserve: one group of officials leans towards initiating cuts soon to counter possible economic slowdowns; the majority emphasize the importance of continued evaluation of tariff impacts and labor market changes, advocating for patience to avoid overreacting in policy adjustments; a third group feels that current economic indicators do not yet sufficiently justify the need for rate cuts.

Analysts point out that differing expectations about tariff-induced inflation pressures and economic growth impacts are primary reasons for these divisions. Some officials who support quicker rate cuts expect tariff effects to be mild and short-lived, while those in favor of waiting are concerned tariffs could drive prices up over a longer cycle.

Market Focuses on Upcoming Inflation Data

The Federal Reserve mentioned in the minutes that it will closely monitor the forthcoming June CPI data to assess effects on policy pathways. With the July meeting approaching, there is widespread market expectation that the Federal Reserve may reconsider the rate cut window in September, rather than taking immediate action in July, based on data changes.

Investors are also evaluating signals from Federal Reserve Chair Jerome Powell and other board members during public addresses to gauge future policy directions. Although Powell has not explicitly supported a July rate cut, there remains significant market speculation about policy adjustments in September and December.

U.S. Economic Resilience Provides Policy Space for the Federal Reserve

Despite continued attention to tariff-induced inflation risks, recently released employment and manufacturing data indicate resilience in multiple areas of the U.S. economy. The unemployment rate remains low, and the labor market is stable, providing the Federal Reserve with room to balance between addressing inflation and economic slowdowns.

Additionally, internal discussions within the Federal Reserve involve framework review and updating communication tools, expected to drive greater flexibility in economic predictions and policy adjustments in the future, aiding officials in effectively responding to economic and market uncertainties.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(95413)

Previous: Market Insights: Jan 17th, 2024

Related articles

- The big reveal of base salaries in forex sales, come see if you are lagging behind!

- The US dollar remained steady as tariff uncertainties heightened market concerns.

- German elections boost the euro, while the dollar weakens and Fed rate cut expectations rise.

- Trump imposes a 25% tariff on the EU, escalating trade tensions.

- GTX EXCHANGE Scam Exposed: Don't Be Fooled

- The U.S. dollar weakens as the yen and euro rise.

- The Night Before the Pound's Turmoil: Bailey Admits Weakness in the UK Labor Market

- The U.S. dollar is under pressure, while the euro and Asian currencies are beginning to shine.

- Market Insights: Mar 19th, 2024

- The weakening of the US dollar has led the Chinese yuan to fall to a 17

Popular Articles

Webmaster recommended

AHF ULTRA Trading Platform Review: High Risk (Suspected Fraud)

China's demand could pose a threat to crude oil bulls.

The US dollar weakened against the yen as the market focuses on Trump's tariff policies.

U.S. policy uncertainty boosts inflation risk, prompting high interest rates.

Rakuten's Major Move: Integrating Credit Card and Mobile Payment Services

US and Japan meet again, exchange rate issue does not hit the red line.

The U.S. dollar weakens as the yen and euro rise.

U.S. Treasuries lose appeal as foreign investors may shift to domestic bond markets.